Overview

Focused on providing pet owners with access to both health coverage as well as preventative coverage, Pumpkin is one of the most well-rounded insurance providers on the market. Based around the understanding that access to preventative care helps to reduce preventable illnesses and catch problems early, Pumpkin has put a lot of effort into designing an optional preventative coverage plan that is affordable and accessible. Pumpkin also offers an insurance policy that gives each owner an extensive amount of coverage.

Every policy through Pumpkin includes a high reimbursement percentage. Coverage won’t decrease as your pet ages, and Pumpkin has kept their policies simple and transparent without any hidden fees or sneaky costs. Awarded “Best Pet Insurance for Comprehensive Coverage” in 2020 by Business Insider, Pumpkin is one of the top choices for any pet parent looking to get robust coverage at an affordable monthly price.

| PROS | CONS |

|---|---|

Offers Coverage for Accidents, Illnesses, & Optional Preventative Care Offers Coverage for Accidents, Illnesses, & Optional Preventative Care |  Reimbursement Percentage is Set with No Option to Customize Reimbursement Percentage is Set with No Option to Customize |

No Upper Age Limits or Breed Restrictions No Upper Age Limits or Breed Restrictions | |

90% Reimbursement on All Policies 90% Reimbursement on All Policies | |

Ability to Use Any Licensed Vet in the USA or Canada Ability to Use Any Licensed Vet in the USA or Canada | |

Covers Both Chronic Conditions & Dental Disease Covers Both Chronic Conditions & Dental Disease | |

10% Discount Available for Additional Pets 10% Discount Available for Additional Pets |

Coverage

Keeping this simple and making sure that their policies aren’t overwhelming or confusing, Pumpkin has a singular plan option available which then includes the ability to add on preventative care coverage if you so choose. There is no accident only coverage option and regardless of your pet’s age or breed you will enjoy coverage for both accidents and illnesses. Pumpkin gives you access to treatments and services for common accidents and illnesses, as well as the ability to see the vet for some less commonly covered things.

For full details on everything that Pumpkin covers, as well as an in-depth look at what is included with the preventative care add-on, you can visit their website directly where they explain everything and even provide a sample policy for you to read.

Screenshot taken from Pumpkin's website

Benefits

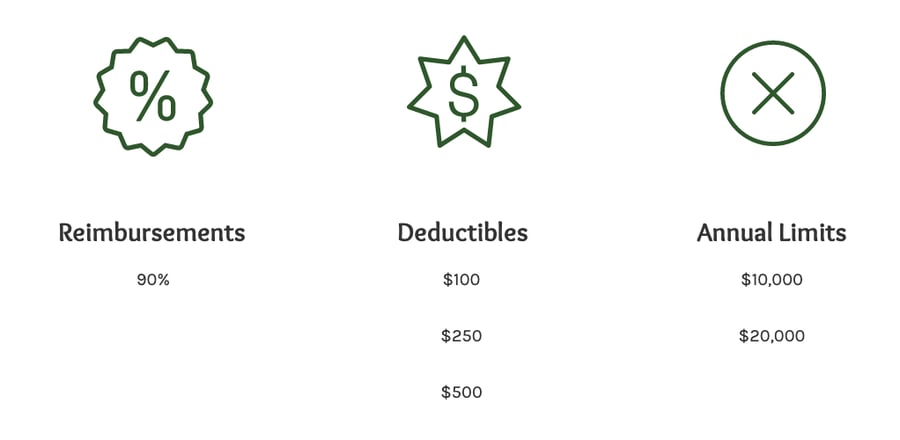

Although there is only really one plan option to select, as well as the ability to include preventative care coverage, Pumpkin does allow you to customize your coverage by selecting both the deductible as well as the annual limit you want. Where Pumpkin differs, however, from many other insurance providers is that they use a pre-set reimbursement percentage of 90% regardless of your policy.

Having such a high reimbursement percentage without having to pay extra is a huge benefit of choosing Pumpkin, as typically increasing your amount to this would also raise your monthly premiums along with it. The reimbursement amount is how much Pumpkin refunds you for eligible claims after your deductible has been satisfied. Giving you 90% back and leaving you to be responsible for the remaining 10% out of pocket means vet care is even more affordable than ever before.

When enrolling, Pumpkin will suggest an annual limit and deductible amount based on the answers you gave during the questionnaire, but you are free to alter these as you see fit. The annual limit can be set at either $10,000 or $20,000 for dogs, and $7,000 or $15,000 for cats, and this is simply the cap for how much you can claim in a year before the remaining vet bills are fully out-of-pocket.

As for the deductible, choosing the lowest option of $100 will save you money when you go to file a claim, but it will also increase your monthly premiums. Likewise, if you decide to pay a $500 annual deductible you are responsible for more out-of-pocket before your insurance kicks in, but it will save you money each month via your premiums. To figure out what works best for you, you can play around with the numbers during your quote process and see how much it affects your price right away.

Reimbursement

With a set reimbursement percentage of 90%, every pet owner who is enrolled with Pumpkin will get to enjoy one of the highest eligible reimbursement percentages around without having to pay extra in order to have it. In terms of how this will actually impact you during a vet visit, once you have satisfied your deductible, any eligible claims after that will give you 90% back. If your eligible claim happens to be for $1,000, for example, this means Pumpkin will give you back $900 and you only have to cover that last $100 yourself if your annual deductible is already satisfied.

Eliminating the need for endless paperwork, long wait times, and annoying phone calls, Pumpkin has created a fast and efficient claims process that is easy to use. After visiting any licensed vet of your choosing within the USA or Canada, you will then take your receipt and upload it online along with your virtual claim form. Claims are processed quickly and your reimbursement will then be sent to you either by check or it will be directly deposited into your bank account.

Not sure you can necessarily afford to pay the bill upfront and wait to be reimbursed? If your vet doesn’t require payment immediately then you can have Pumpkin pay the vet directly. All you have to do is choose “reimburse my vet” when filing your claim and Pumpkin will take care of the rest.

Prices

How much you ultimately spend each month with Pumpkin is going to depend on what type of coverage you want, as well as personal factors such as where you live and how old your pet is. This is why it is so important to visit their website directly to obtain your free quote instead of trying to guess. Pumpkin is clear and transparent with their costs and the free quote process will ask you a number of questions in order to perfect your plan and give you an accurate monthly premium that you can then take advantage of.

What makes Pumpkin unique is that their reimbursement percentage is already set for you, so while you can alter your deductible and annual limits, you never have to worry about paying more just to be eligible for more money back on eligible claims.

Another way in which Pumpkin saves owner's money is by removing the option for an unlimited annual policy and instead offering either a $10,000 or $20,000 limit for dogs and $7,000 or $15,000 limit for cats. Plans with unlimited annual limits often cost much more, and you may never use it, and that money can be better spent spoiling your cat or dog year-round.

Enrollment

If you are interested in checking out Pumpkin, or if you’re ready to jump in and get your dog or cat enrolled, you can complete the entire process online via their website. Featuring a streamlined enrollment form, you will be asked a few questions about your pet as well as a few about yourself. Pumpkin also inquires about things such as your pet’s activity levels, what types of things you are concerned about, and what you are hoping to get out of your insurance policy.

Although your generated policy will have suggestions made for you, there is still the ability to customize it to your taste, as well as the ability to decide whether or not preventative coverage is for you. At Pumpkin, preventative care is considered a very important part of your pet’s overall wellness and health, and this is why it is highly recommended that you include it. However, the choice is ultimately yours and you can decide to have just an accident and illness policy if you so choose.

Extras

Pumpkin takes preventative care seriously and they focus on making sure this is an option that is both affordable and accessible for all pet owners. Creating only a small increase to your monthly premiums, the preventative care plan covers a number of things that would otherwise be paid for out-of-pocket by you. Some of the key benefits you can enjoy when you sign up for preventative care coverage include:

- Full reimbursement for one annual wellness exams and check-ups

- Full reimbursement for key tests and screenings for parasites and diseases

- Full reimbursement for essential vaccinations

Included in your preventative care package are many of the vet-recommended benefits.

Contact

To take advantage of the free quote offered by Pumpkin, or to learn more about what they offer, you can visit their website directly. Here you will find in-depth breakdowns of what is included versus excluded in your policy, as well as see what you and your pet are eligible for cost-wise.

Prefer to call or email? The team at pumpkin can be reached by either sending them an email at [email protected] or over the phone at 1-800-ARF-MEOW

6American Pets Product Association, “2017-2018 APPA National Pet Owners Survey.”

Estimated lifetime cost for a dog living 12 years based on annual spend data from survey (12 years at $1,386 per year).

Pumpkin Company Info: Pumpkin Pet Insurance policies do not cover pre-existing conditions. Waiting periods, annual deductible, co-insurance, benefit limits, and exclusions may apply. For full terms, visit pumpkin.care/insurancepolicy. Products and rates may vary and are subject to change. Discounts may vary and are subject to change. Pumpkin Insurance Services Inc. (“Pumpkin”) (NPN#19084749) is a licensed insurance agency, not an insurer. Insurance is underwritten by United States Fire Insurance Company (NAIC #21113. Morristown, NJ), a Crum & Forster Company and produced by Pumpkin. Pumpkin receives compensation based on the premiums for the insurance policies it sells. For more details visit pumpkin.care/underwriting-information. Pumpkin Preventive Essentials is not an insurance policy. It is offered as an optional add-on non-insurance benefit. Pumpkin is responsible for the product and administration. For full terms, visit pumpkin.care/customer agreement. Pumpkin Preventive Essentials is not available in all states. Paid endorsement - Pumpkin Insurance Services, Inc. is responsible for their information in this advertisement.