Overview

Founded in 2018, Prudent Pet is an insurance provider for cats and dogs that is created for pet parents, by pet parents. Based out of Hillside, Illinois, it offers customizable policies for both accidents and illnesses, as well as add-on coverage for preventative care and overall wellness. Designed to help every cat or dog get the help they need, when they need it, Prudent Pet employs agents who have a background in veterinary care and also provide a 24/7 vet chat line so owners can get quick answers to any questions they may have day-to-day.

Keeping pet insurance simple, Prudent Pet has a straightforward enrollment process and budget-friendly plans, as well as an AI-powered claims process for faster reimbursement. Personalized coverage limits, reimbursement percentages, and deductibles allow pet owners to get the exact policy they want, and the company is backed by one of the best-known underwriters for added security and confidence that your premiums are money well spent.

| pros | |

|---|---|

PROS PROS |  CONS CONS |

Covers Cats or Dogs of All Ages & Breeds Covers Cats or Dogs of All Ages & Breeds |  No Coverage for Pre-Existing Conditions No Coverage for Pre-Existing Conditions |

3 Plan Options to Select From 3 Plan Options to Select From | |

Veterinary Exam Fee Coverage & Wellness Coverage Available Veterinary Exam Fee Coverage & Wellness Coverage Available | |

Ability to Visit Any Licensed Vet in the USA Ability to Visit Any Licensed Vet in the USA | |

Customizable Reimbursement & Deductible Amounts Customizable Reimbursement & Deductible Amounts | |

Lightning-Fast Claims Process Thanks to AI-Technology Lightning-Fast Claims Process Thanks to AI-Technology | |

10% Discount for Multiple Pets 10% Discount for Multiple Pets |

Coverage

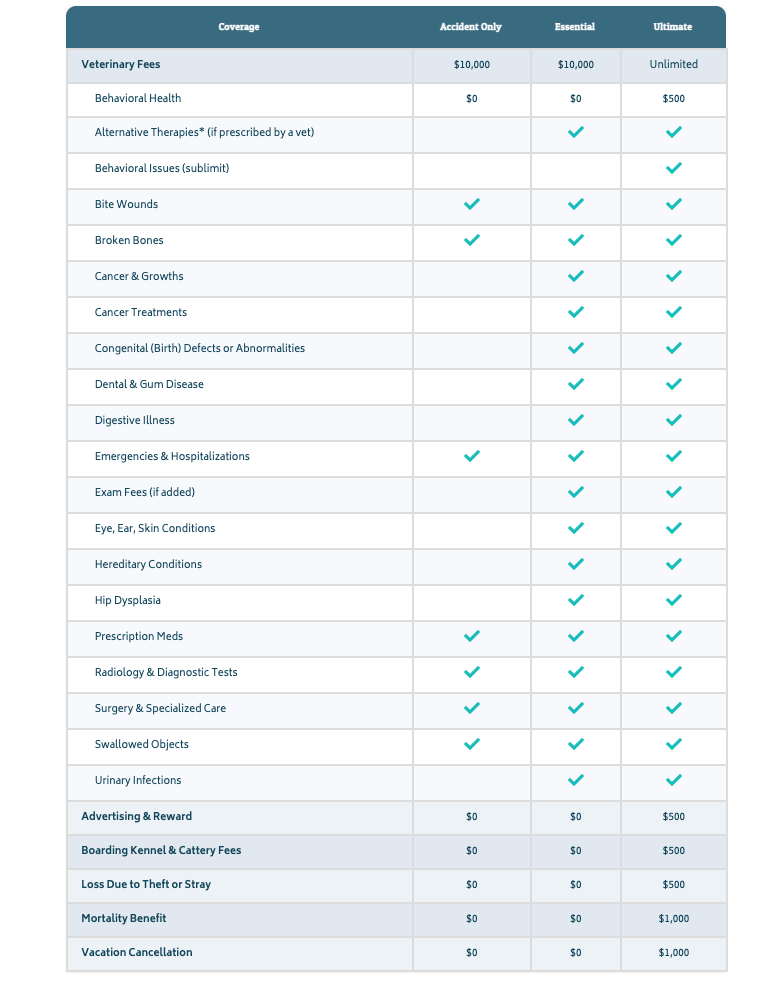

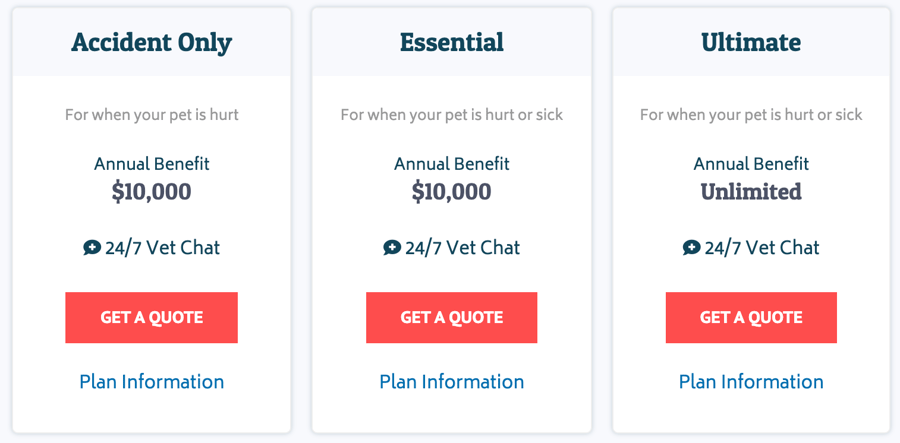

Prudent Pet offers 3 main insurance coverage plans, each with the ability to be customized in order to suit what works best for both you and your pet. Broken down into accident or accident and illness options, every owner will be able to decide which situations they are looking to receive financial help with, as well as how much they ultimately want to pay in premiums every month.

Unlike other providers, Prudent Pet does not have any upper age restrictions for coverage, meaning your pet is eligible regardless of whether they are a puppy or a senior. In addition, senior pets are not limited to accident-only coverage and you are welcome to decide whether you want coverage for just accidents, or if you want illness protection as well. Pre-existing conditions, of course, are still excluded from your policy regardless of age, but for anything not relating to a previous condition your senior pet will be eligible for reimbursement.

Prudent Pet finds that perfect balance between comprehensive coverage, while still ensuring plans remain budget-friendly and inclusive. As for the precise coverage each plan offers, everything is clearly listed both on the Prudent Pet website, as well as during the free quote and enrollment process.

Benefits

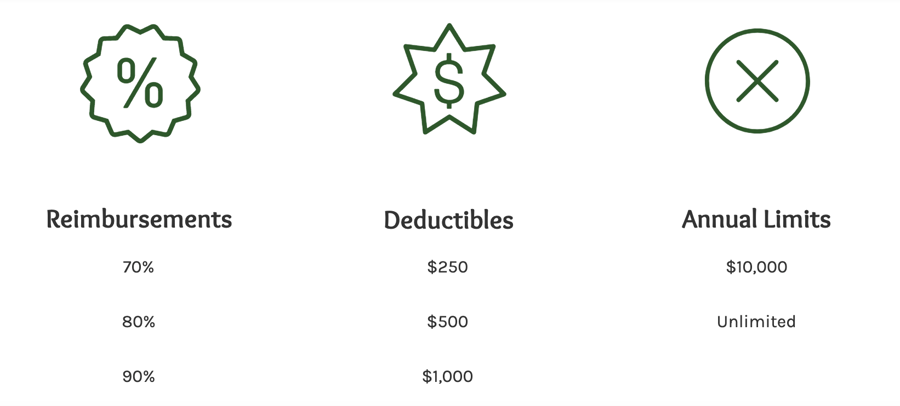

The 3 main plan options are only the starting point with Prudent Pet, and you can further fine-tune your policy so that the deductible and reimbursement amount are set to what you want them to be. Increasing or decreasing either of those two options will impact your overall monthly premium, however, when you are enrolling you will be able to see the exact price you are expected to pay as you play with those numbers.

Deductibles are how much you are expected to pay out of pocket before your insurance coverage kicks in, and with Prudent Pet this amount is calculated on an annual basis. Each year, you must satisfy that deductible before claims will be reimbursed, so you will want to select an amount that is in line with what your personal budget is.

Reimbursement, however, is the percentage that Prudent Pet will refund you once your deductible has been satisfied. The remaining percentage not covered will be how much you are expected to pay out of pocket. For example, if your vet bill is $1,000 and you have a reimbursement percentage of 80%, then after you have met your deductible Prudent Pet will cover $800 of the bill and you will be responsible for the remaining $200.

Reimbursement

The average reimbursement amount for those who have a policy with Prudent Pet is 80%, although those who are looking for lower monthly premiums may choose 70%, while those who want to pay more monthly but save later on can select 90%. Regardless of what you opt for, the process for reimbursement is the same, and Prudent Pet uses AI-powered technology to make this process as quick and easy as possible.

Each time you visit the vet for something that is eligible for coverage based on your plan, you will then be required to pay the vet directly and then submit a claim to have that amount reimbursed. Traditionally, this process could take weeks to complete, but Prudent Pet has a lightning-fast claims process that can have funds back in your bank account quicker than ever.

Sent by check, or directly deposited into your bank account, customers find that they receive their money in as little as 4 days after having their claim approved.

Prices

How much you ultimately pay monthly in premiums will depend heavily on both individual factors, as well as the policy you select and how you choose to customize it. Where you live, how old your pet is, and even the breed can all factor into the final cost which can range from around $20 per month up.

Additionally, a higher reimbursement percentage or lower deductible will both increase the pricing, so those who are looking to save money on their premiums can play around with both of these numbers until they find that sweet spot between adequate coverage and a price that doesn’t break the bank. Deciding to go with an Accident-Only Plan is another way to lower premiums, or, if you do want accident and illness coverage, you can choose the Essential Plan which has a $10,000 annual cap.

If cost isn’t a factor for you, the Unlimited Plan will give you the most expansive coverage available, with no annual limits on how much you can claim. This covers both accidents and illnesses, and you can further customize both the deductible and reimbursement percentage to suit your needs.

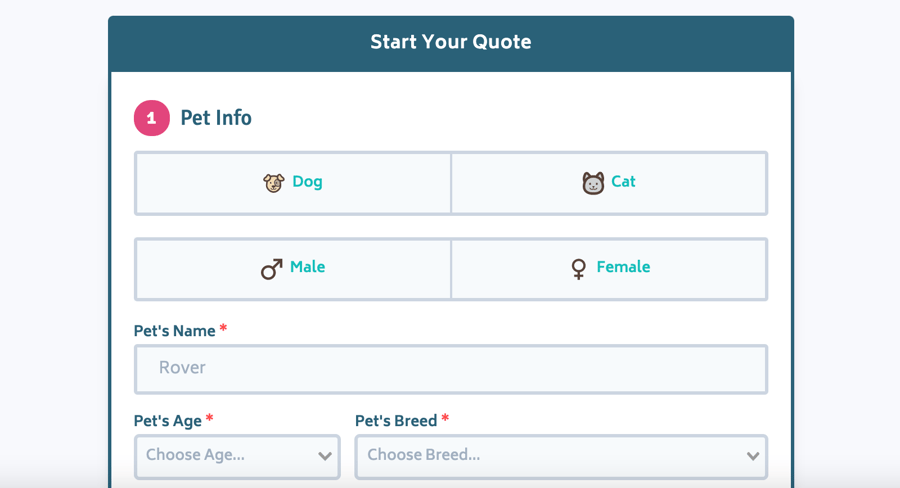

For an accurate look at how much you can expect to pay based on your information and preferences, you can visit the Prudent Pet website and take advantage of their free quote offer. Quick, easy, and accurate the quote process only takes a few moments to complete and will show you the exact monthly premium amount you would be expected to pay if you were to sign up right then and there.

Enrollment

Getting started with Prudent Pet is very straightforward, and it only takes a few minutes from start to finish before you and your pet are enrolled. Beginning with their free quote, you will first enter some information about your pet such as whether they or a cat or dog, how old they are, and what their breed is. From there, you will then be asked some questions about yourself helping Prudent Pet to identify where you live.

After you have completed the entire quote process and select the various reimbursement percentages or deductibles, and you’re happy with the cost, you can then look through any of the add-on benefits available as well as add another pet onto your policy for a 10% discount.

The premium you are provided with during the quote process will ultimately be your final total, and once satisfied you are simply taken to a check-out screen where you can pay. As soon as the payment has been completed, your pet is enrolled with Prudent Pet and the clock begins on their 14-day waiting period. As with virtually all insurance providers, the wait period is the gap between when you enroll and when your policy comes into effect, meaning you are unable to file any claims during this time. However, once your 2 weeks are up, your policy is ready to go and you can begin using it whenever you need to.

Extras

Prudent Pet doesn’t just limit pet owners to accident and illness coverage, and instead they do provide options for owners who are interested in wellness/preventative care, as well as extra coverage for examination fees. Both of these options are completely voluntary, and you are by no means required to add either of them on, but they are worth considering if your budget allows for it.

Veterinary Exam Fee Coverage is one add-on that will help get you more money back each time you visit the vet for an eligible accident or illness. Without this, you are responsible for not only paying your deductible and reimbursement percentage, but you also need to pay for that initial exam fee yourself. Depending on where you go, this fee can be $100 or more, with the average cost sitting at around $45 - $50 per visit.

Wellness Coverage, on the other hand, expands what your pet is eligible for and you will be able to file claims for costs beyond just what's related to an accident or illness. Routine care such as check-ups, vaccinations, and even dental cleanings all fall under Wellness Coverage and keeping on top of these things can help keep your pet healthier and prevent them from getting sick in the future. Prudent Pet breaks their Wellness Coverage down into 3 options:

- Low: Includes 8 preventative benefits with a maximum of $210 annually in coverage

- Medium: Includes 9 preventative benefits with a maximum of $315 annually in coverage

- High: Includes 11 preventative benefits with a maximum of $460 annually in coverage

Both add-on options will be offered to you at the time of enrollment and the cost associated with each will be clearly laid out so you can see how they will impact your monthly premiums. If you are interested in adding either, or both, on to your plan you can do so before you finalize your choices and check-out.

Contact

To take advantage of the free quote that Prudent Pet offers to new customers you can visit their website directly and fill out the questionnaire online. You can also use their on-screen chat box beforehand if you want to ask questions or get clarification about any of Prudent Pet’s coverage details, exclusions, plans, or processes.

Those who prefer to email Prudent Pet can do so using their “Contact Us” form, available on their website, and there is also the ability to call them directly at 888-820-7739.